Happy Monday Morning!

Canadian banks reported first quarter earnings this past week. Those earnings provided an important glimpse into what’s shaping the nations housing market. Deep in the footnotes, CIBC reported that $52-billion worth of mortgages – the equivalent of 20% of the bank’s $263-billion residential loan portfolio were in a position where the borrower’s monthly payment was not high enough to cover the interest portion of the loans. The bank has allowed these borrowers to stretch out the length of time it takes to pay off the loan, which is known as the amortization period. As well, borrowers are adding unpaid interest onto their original loan or principal.

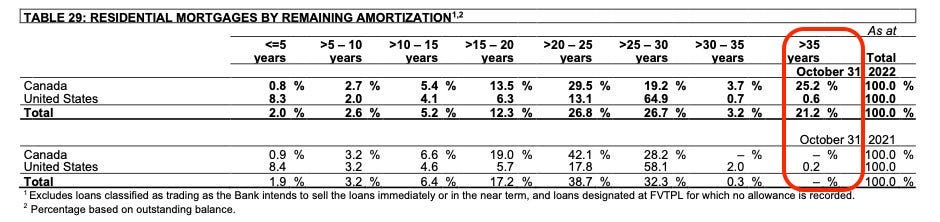

CIBC isn’t alone. Both TD and BMO also allow mortgages to negatively amortize. Assuming you took out a fixed payment variable rate mortgage at TD, you can allow outstanding interest to be tacked onto the balance of the loan, so long as your loan-to-value ratio does not exceed 80%. In other words, defer any pain resulting from higher interest rates. As a result, amortizations are growing. At TD bank, 25.2% of their residential mortgages now have an amortization of 35 years or greater. A year ago, that number was essentially zero.

If you’re wondering why there hasn’t been a wave of distressed sellers you can thank the Canadian banks. They are actively protecting their own loan book by sheltering Canadian households from the full brunt of interest rates. Extend and pretend.

It’s true this could be a real issue in several years when borrowers come up for renewal and have to fit the remaining loan balance under a much shorter amortization period. Huge payment shock, and undoubtedly some forced selling.

However, for this issue to escalate a few things need to happen:

Interest rates stay elevated

Prices remain flat to down

OSFI doesn’t intervene

Remember OSFI is in charge of monitoring financial stability risks and this one is glaringly obvious.

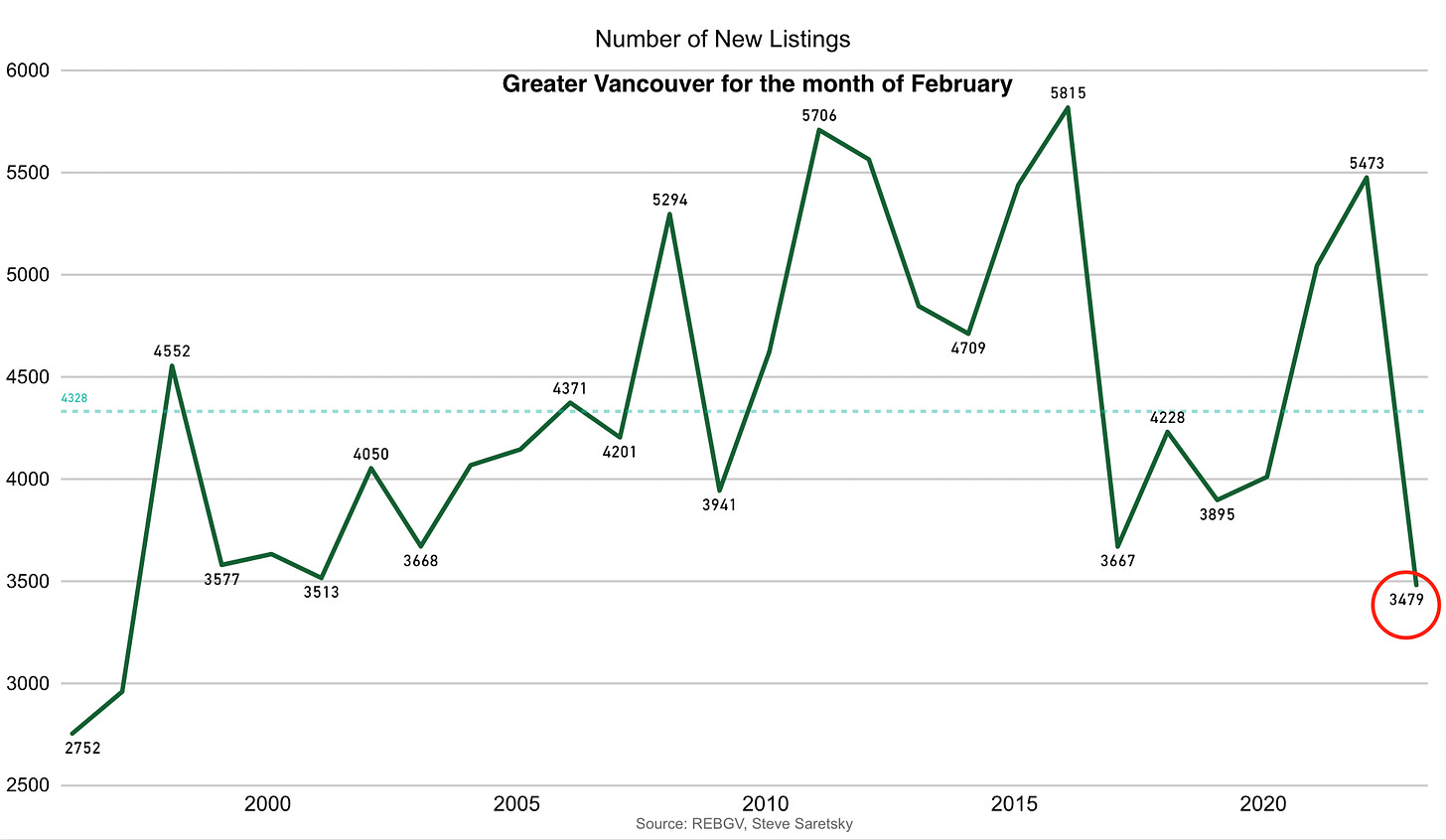

For now the pain has been mitigated, distressed sellers are few and far between. The housing market is plagued by a lack of new listings coming to market. In Greater Vancouver new listings for the month of February hit their lowest levels in 26 years!

Fewest number of new listings since 1997. The lack of distressed sellers is one thing, but there are a few more dynamics at play.

People don’t sell unless there is also something for them to buy

Upsizing is a lot more expensive given the surge in borrowing costs

Market conditions remain highly uncertain. People don’t like uncertainty.

This is not just a Vancouver phenomenon. Recent data trickling out of the GTA shows new listings sunk by 42% year-over-year in February, falling to their lowest levels in 20 years.

In Calgary, inventory levels for the month of February sit at their lowest levels since 2006. According to CREB, “While higher lending rates are impacting sales activity as expected, we are seeing a stronger pullback in new listings, keeping supply levels low and supporting some stronger-than-expected monthly price gains.”

So, while the macro continues to deteriorate, ie rising amortization periods and larger loan balances on highly indebted households, a resurgence higher in bond yields, and zero economic growth in the fourth quarter, the housing market is actually firming up, not down.

I suspect this fairytale still has a few chapters left to write, and the clues lie in the footnotes of bank earnings.

This is the best information to describe why prices have remained elevated. Unbelievable!

Like trying to fight a war and not take casualties... now the banks are undermining everything the central bank is trying to do because nobody wants to take the pain. Justin will get out just in time and it will be Pierre's fault (remember the state of the US when Obama took office the first time around)