Happy Monday Morning!

Lots to unpack this week so let’s dive in. Sales figures for the month of November are making for more negative headlines, as they probably should. There is little optimism in the latest data. Greater Vancouver home sales were down 53% on a year-over-year basis. Over the past two decades there have only been two slower months of November (2008 and 2018). Prices are still trickling lower, despite inventory levels remaining surprisingly low. It’s a similar story in the GTA, home sales fell 54% from last year, and were the lowest since November 2008. A four hundred basis point rise in mortgage rates is going about as well as one would expect, and we’re about to get another Bank of Canada rate hike this Wednesday.

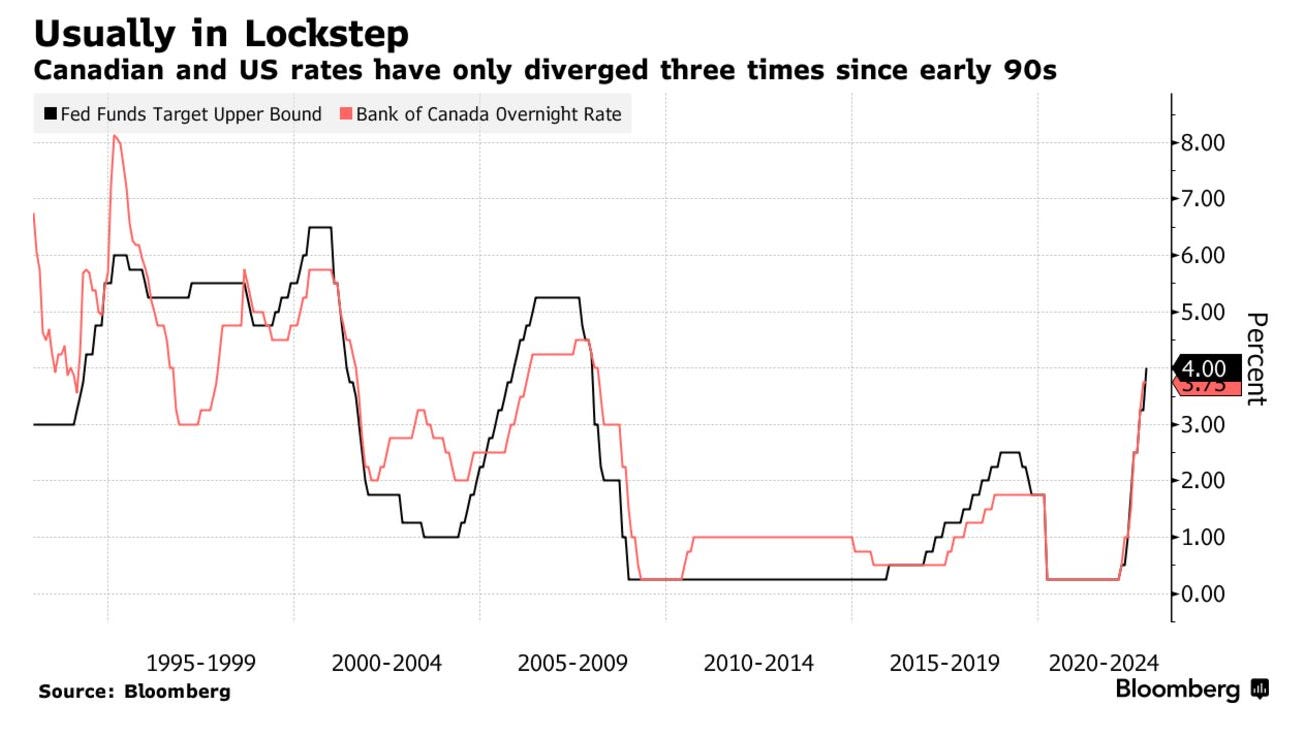

The good news is this is probably the end of the line for the Bank of Canada, at least that’s my view. Macklem will seal the deal with another 25bps and bring this rate hike cycle to a close at 4%. A survey of Bloomberg economists seem to think the same, suggesting Governor Tiff Macklem can comfortably leave their benchmark rate as much as 100 basis points lower than the Fed.

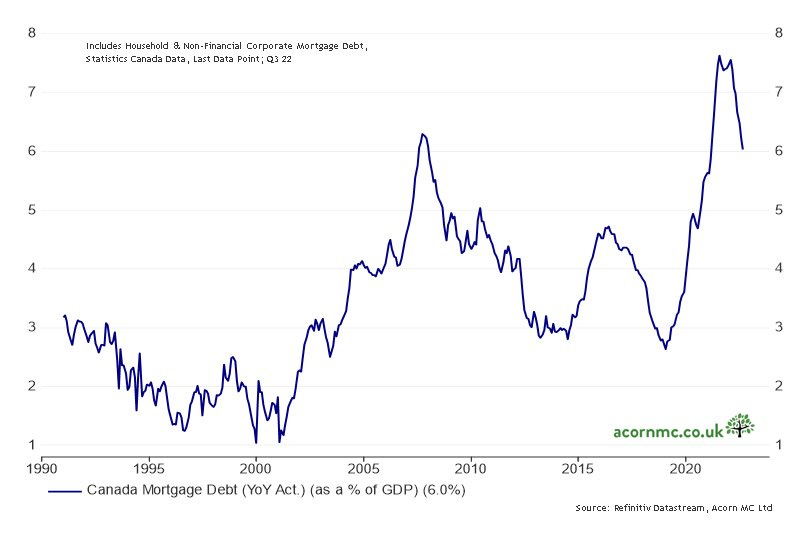

I’m not going to list all the reasons why the Bank of Canada has a lot less room than the Fed, they’ve been listed a million times. This country is suffocating in debt and that last few years of growth were largely driven through even more debt. The growth in mortgage debt as a percentage of GDP nearly touched 8% this cycle.

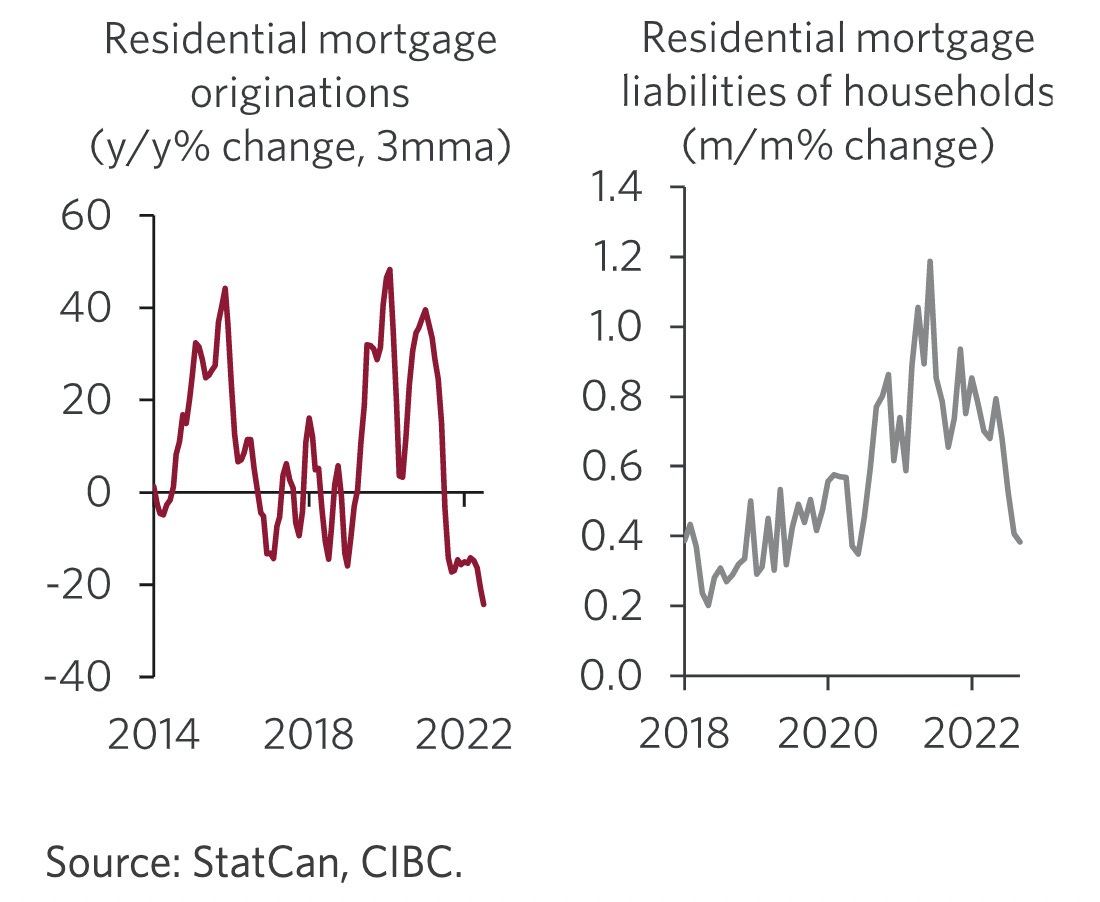

These types of excesses are always followed by hangovers. According to CIBC, “Mortgage originations are now falling by close to 30% on a year-over-year basis. We estimate that in 2022, the rapid rise in mortgage rates directly and immediately impacted one quarter of borrowers. We estimate that before the pandemic, no less than one-third of investors were in negative cashflow territory. Given the tightening in monetary policy that has occurred since then, and the additional rate hikes that are still forthcoming, that negative cash flow position is certainly broader and deeper than it was pre-pandemic.”

In other words, we pulled a lot of demand forward, a hangover was inevitable. But when you suddenly add a 400bps move in mortgage rates in less than a year there becomes a lot of collateral damage. We’re increasingly seeing stories of investors eating big monthly losses as interest payments on their mortgage surge higher with an inability to pass along those costs in rent controlled provinces like BC & Ontario. For some there are very few options but to sell. For others who can hold out, it should not be forgotten that an estimated 700,000 individuals are entering Canada in 2022

(including new immigrants, foreign students, non-permanent residents, and

newcomers from Ukraine on a special 3-year visa). Despite the destruction of some Mom & Pop landlords, I suspect we will still be talking about a housing crisis five years from now.

If you have not already sold this only gets worse as BOC is not going to reverse even if they slow down. Rates are just reverting to their long term average. Lot of pain to come in 2023 & having a Govt & BOC governor who have been peddling ultra Low rates & overspending for way too long the hangover is getting worse with C$ Already down 6% over the last 1 year despite the interest hikes

will the immigrants be able to come up with down payments and will they qualify for financing If not, demand will not likely increase.