Happy Monday Morning!

As expected, Macklem and Co slashed rates by 50bps this past week, citing slower growth and a softening labour market. Further adding, “if the economy evolves broadly in line with our latest forecast, we expect to reduce the policy rate further.” Remember that line, we’ll come back to it.

So the Bank of Canada is poised to cut rates further. In fact, another jumbo cut is on the table for December. The overnight rate, and thus, variable rate mortgages are plunging. However, fixed rates are not budging! As we had cautioned several weeks ago, the bond market had already priced in the rate cuts. The BoC cut 50bps this past week and the Canada 5 year bond yield pushed higher!

Even still, that won’t prevent Canadians from speculating on the direction of housing. Animal spirits in this country are fickle. We’ve already seen a noticeable uptick in resale activity over the past month, and I suspect another jumbo cut could supercharge that. It’s no wonder the BoC is now forecasting a 6% increase in residential investment next year along with higher home prices. You now have the BoC and the Feds trying to kickstart the housing market. Remember, just a few weeks ago finance minister Freeland told Canadians they can soon borrow up to 92% on a 1.5M home!

Just when you think the next bull market is right around the corner, the feds pull an abrupt U-Turn on immigration. In a shocking move this past week, the Trudeau government announced a sharp reduction in permanent resident targets and put new caps on non permanent residents. Including, an annual cap on international student study permits and temporary foreign workers. In other words, they’re closing the barn door after the horse has bolted.

So what does this all mean?

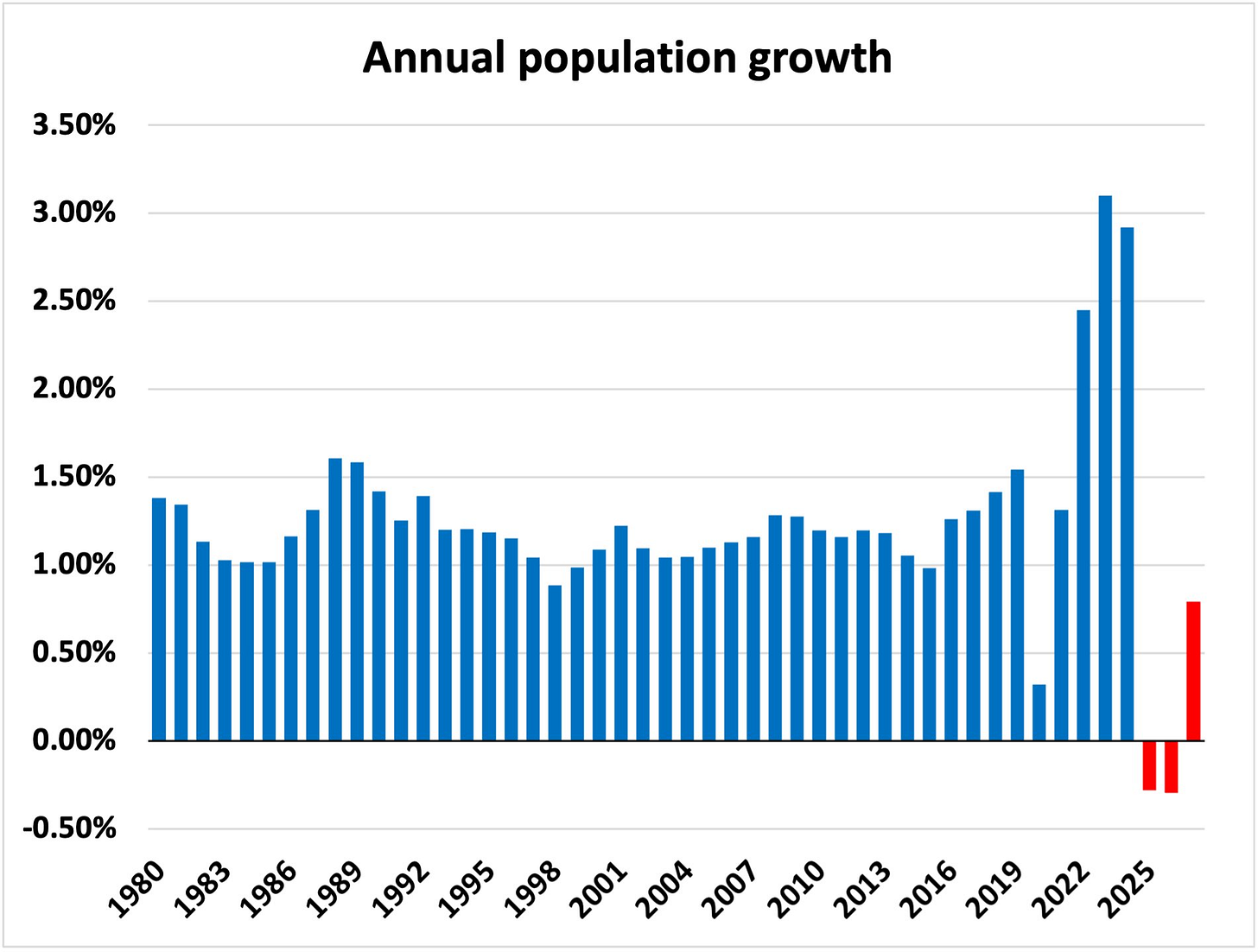

It means population growth is going to go from 1.2 million per year to ZERO over the next two years. In fact, Canada’s population is projected to contract over the next two years as by 0.2% as nearly 900,000 temporary residents are asked to leave!

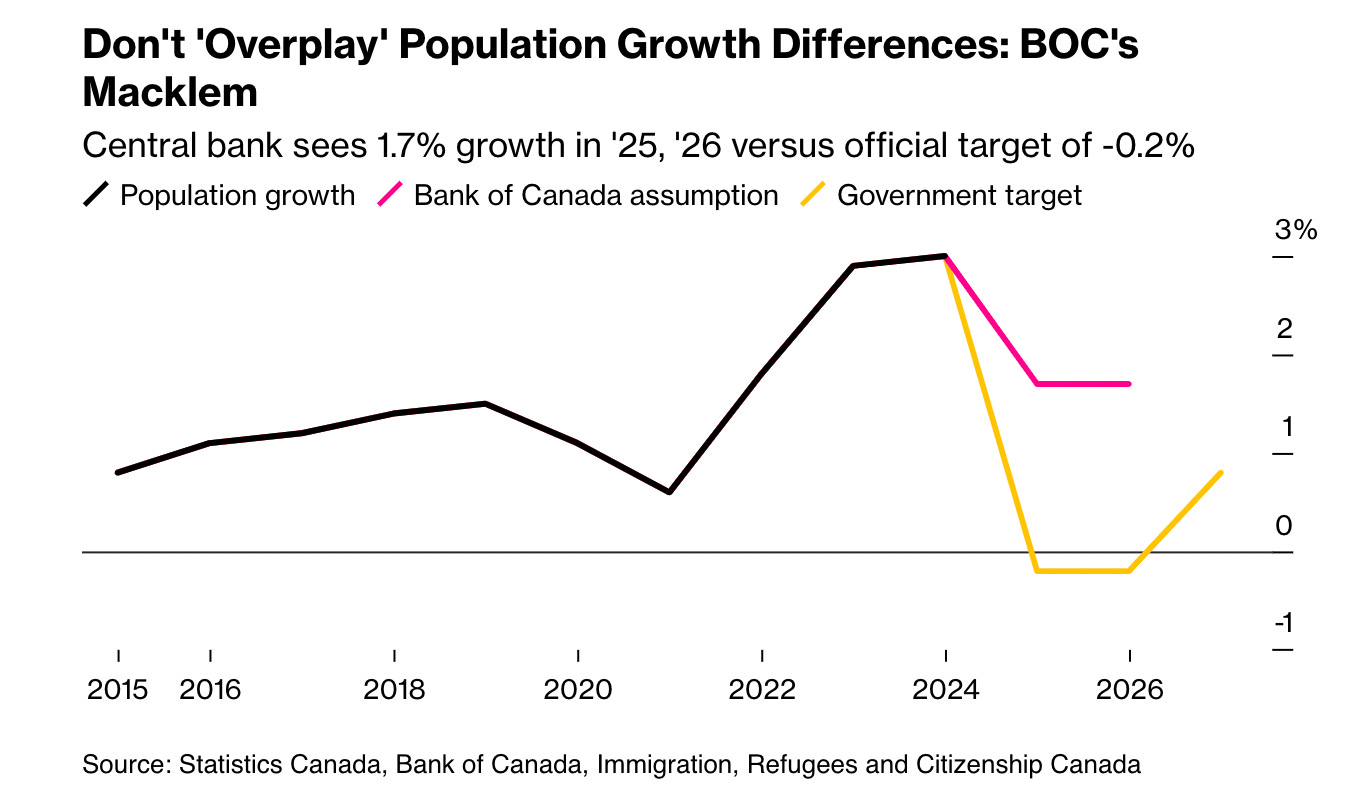

The implications here could be profound. The Bank of Canada’s own economic projections had estimated 1.7% population growth over the next two years, compared with the Trudeau government’s recently announced 0.2% reduction in 2025 and 2026. So 700,000 workers will vanish from the Bank of Canada's modeling of the Canadian economy over the next two years, now what?

RBC now suggests that economic growth could be a full percentage point lower as the immigration taps are turned off. Lower growth, and fewer people competing for shelter. All of this sounds very disinflationary.

Remember, rents are already falling in Vancouver and Toronto, and we now have a record number of new condos and rentals under construction, all completing over the next few years. Supply cometh, but the immigrants are not.

If you wanted to make a bull case for even lower interest rates, there you have it.

Of course all of this is hypothetical. The Trudeau government has to actually execute on this policy, and execution is not exactly their strong suit. They also have to survive another election which looks increasingly unlikely. However, given the polls suggest more than 70% of Canadians feel immigration levels are too high don’t expect much different from a Poilievre government.

In summary, if we take everything at face value, zero population growth should manifest in lower growth, lower rates, and lower rents. It also means Toronto condo developers will need to find a new sales pitch, at least for now.

Canadian dollar going to get obliterated