Free Markets

Happy Monday Morning!

This newsletter isn’t all bad news. We finally got some good policy out of Ottawa this past week. OSFI, the banking regulator, announced it will finally remove the stress test for homeowners who wish to switch lenders at mortgage renewal time.

Under previous guidelines, when the mortgage term ended and a borrower had to renew their loan, borrowers were required to pass the mortgage stress test if they wanted to switch to a different lender.

This made little sense considering the borrower was not stress tested again when renewing their mortgage at their existing lender. However if the borrower wanted to move their business to a different lender for a more competitive rate, even a “straight switch” where the borrower remains on the same amortization schedule, is not lengthening the time they will take to pay off the mortgage, and is not increasing the amount of their loan, was considered no bueno.

In other words, once rates surged higher, many existing borrowers were unable to pass the higher stress test and were effectively trapped at their existing lender. As Rob Mclister notes, today, if you want to switch lenders for a better deal on the average $300,000 mortgage, you need to prove $81,300 of income. Once this new policy takes effect, that drops to $71,000 of income, or 12.7% less.

Ballpark industry estimates have suggested that OSFI's policy blocked at least 5% to 10% of switches, but that number grew as rates soared in the last hike cycle. Of course, if you’re the bank and you know the borrower can’t leave you’re probably not motivated to offer a very competitive mortgage rate.

So, after years of lobbying, the mortgage community finally got their wish. The stress test is gone for straight renewals. That’s more business for mortgage brokers and more competitive rates for the borrower. Some might call it a win win.

This won’t do anything for the housing market in terms of activity or prices, but it should save consumers 10-30bps on their next renewal. Much to the chagrin of the big banks.

Suffice to say it’s been an exciting few months for the mortgage community. The Bank of Canada is slashing rates, bond yields are tumbling, the CMHC insured mortgage limited was juiced up to $1.5M, and now the stress test on renewals is gone.

You’d think this would be cause for celebration but the reality is housing activity remains anemic throughout September. While every seller and real estate professional assumed lower rates would translate to a stronger housing market we cautioned that optimism could be met with disappointment. We were worried that lower rates might actually bring an increase in new listings without a material increase in sales and that’s exactly what we’ve seen.

The September selling season has come to a close and Greater Vancouver home sales are a shade under 1850. That’s fewer than the 1900 sales last September, and about 28% below the ten year average for the month. New listings will hit a record high for the month, we have them tracking north of 6500 new listings which would be the highest on record dating back to 1998.

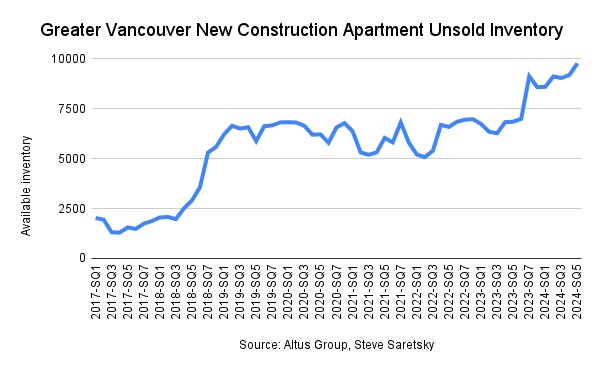

In other words, sales remain virtually unchanged but inventory continues to pile up. Increased competition means price discounting will continue. Keep in mind all the figures we highlighted above are just what’s recorded on the MLS. Off market developers are sitting on nearly 10,000 units of unsold inventory.

Eventually this too shall pass, but probably not this year. Until then it will be a food fight trying to move inventory. For buyers, lower prices, and lower mortgage rates. A recipe for improved housing affordability. Free markets at work.

Sorry, please remind me again how we are in a “free market” environment when a tax payer funded organization shoulders all the risk for the lenders via mandatory mortgage insurance. Remove the CHMC and let the banks handle the risk of default… that’s a free market.

Well said Steve. Twenty years of depraved behaviour of central banks around the world created asset values far in excess of the owner’s income. Sadly, the average Canadian has insufficient knowledge to understand the cause of the current market.

If the deflation adjustment were a Canadian only phenomenon, there’d be minimal impact. However most central banks around the world, directed by their asset rich masters, assumed they could get something for nothing. No one knows the future, but for sure it will be an interesting ride.

Keep up the good work Steve. Canadians need to understand what is really going on. And who is really controlling world financial markets.