A Healthy Cleansing

Happy Monday Morning!

We got more encouraging news on the inflation front. Consumer prices in Canada fell on a seasonally adjusted basis, dropping -0.1% month over month, the first drop since July 2020. Yes, annual inflation still looks very high at 6.3%, but that only tells us what happened a year ago. We discussed these big fat, laggy indexes last week so no need to beat a dead horse. Let’s try to filter through the noise here.

As my good friend Ben Rabidoux points out, Consumer prices have been nearly flat over the past 6 months. Remember, prices don’t have to drop, they just have to stop going up a lot.

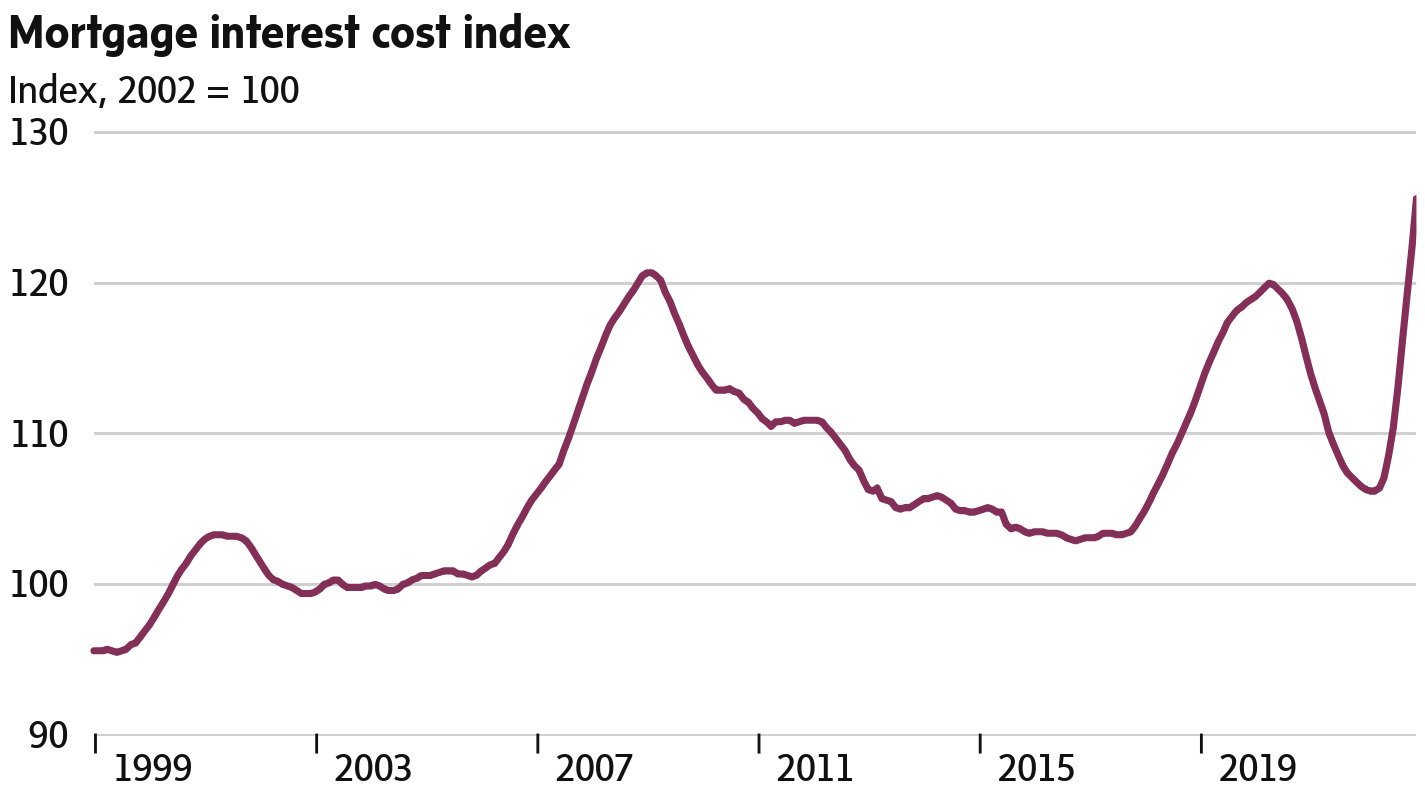

Shelter inflation remains stubbornly high, despite house prices cratering. Ironically, the largest contributor to annual inflation in Canada right now is now mortgage interest costs. A whopping 400bps of tightening on a highly levered household sector will do that.

And we might not be done yet. The Bank of Canada will provide an important update this Wednesday. Markets are still expecting the BoC to squeeze in another 25bps before pausing. Twitter seems to agree.

The Bank of Canada has been pretty unpredictable over the past year. My bet is on 25bps but there are plenty of arguments that support a pause. The obvious one is housing, which has been taken to the woodshed over the past ten months. Since peaking in March 2022, the National Home Price index is now down a whopping 17%, the largest decline on record by a country mile.

To be fair this was definitely a healthy cleansing. Housing speculation had run rampant after years of reckless government policy. There will be more bodies floating to the surface assuming the Bank of Canada has the courage to hold rates for the rest of the year.

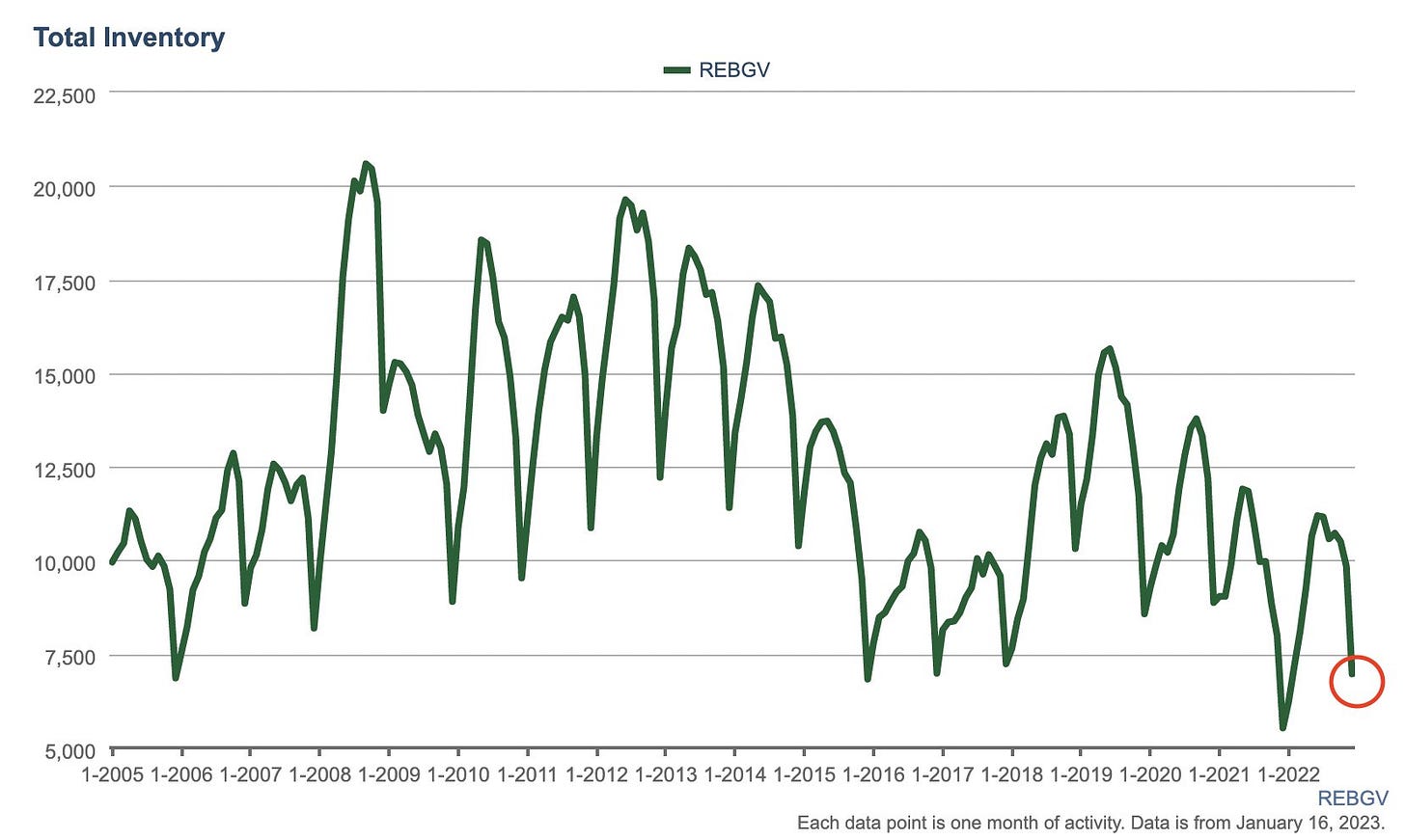

Housing bears will be tested though. Inventory for sale remains stubbornly low. The anecdotal stories of stale listings suddenly going into multiple offers are true. It’s hard to believe it but it’s definitely happening. You have a bunch of buyers who have delayed their purchases throughout 2022 suddenly frustrated over the lack of available inventory. There was a lot of hype about distressed sellers flooding the market but that has not materialized, at least not yet.

Here’s a quick chart of total inventory for sale across all of Greater Vancouver.

Hard to convince sellers to drop their price when there’s no competition. As i’ve said before, the next real test for the housing market will come in March/April when we get our usual uptick in new listings. Just keep in mind inventory levels are starting from a very low base so it will take time for inventory to build to levels that force more price cutting.

It’s also worth watching fixed rates. The Canada 5 year bond yield is now back at levels that would normally put your 5 year fixed rate mortgage in the mid 4’s. Most big banks are now back under 5% if you ask politely and there should be more room to go if yields hold here. Let’s watch.

"Remember, prices don’t have to drop, they just have to stop going up a lot. "

It's a given you are talking your book and mainly are focused on housing prices and affordability, but you ignore "reality" at your own peril. Unless Canadians have had a 8+% increase in income, their "real" (inflation adjusted) cost of living went up and their ability to afford housing went down when you consider the pre-tax earning needed to cover the 6.x% inflation in the last year.... and the next year. And every bit of continuing inflation is added to that burden and the need for incomes to climb if living "affordability" is to return to the already high 2021 level.

Yes, because without that 9% pre-tax raise the TTMonths of inflation still eats away their buying power and that % increases every year, minus an increase in income.

Obviously, the Bank of Canada is NOT supposed to focus on just Home Purchasing in setting rates. In fact, if the BoC tried to encourage a healthier economy it would regulate rates to encourage more healthy economic sectors (despite the Govt. of Canada attacking extractive and agricultural businesses that traditionally were the drivers of the economy). It would be healthier for the country for Real Estate to not be the main driver of prosperity.

I have a simple test to suggest for whether the real estate market is sick: the percentage of non-contingent purchase offers for non-New homes. And I am not talking about financing contingencies.

The Canadian Housing Market was sick at the top and it is still sick because chronically low interest rates since 2009. excessive Govt. regulation, & immigration rate in excess of essential goods and services has encouraged a FOMO mindset and destroyed traditional Canadian prudence.